At Jameson Law, we understand the importance of educating our clients about wills and estate planning.

Our upcoming wills and estate planning seminar will cover essential topics that everyone should know.

From understanding the basics of wills to exploring advanced estate planning strategies, we’ll provide valuable insights to help you secure your legacy.

Why You Need a Will

The Power of a Well-Crafted Will

A will is more than just a legal document; it’s a powerful tool that ensures your wishes are respected after you’re gone. We’ve seen firsthand how a well-crafted will provides peace of mind and protects loved ones from unnecessary stress and conflict.

A properly drafted will gives you control over how your assets are distributed, who will care for your children, and even how your digital assets are managed. It can also help minimize potential disputes among family members and reduce the tax burden on your estate.

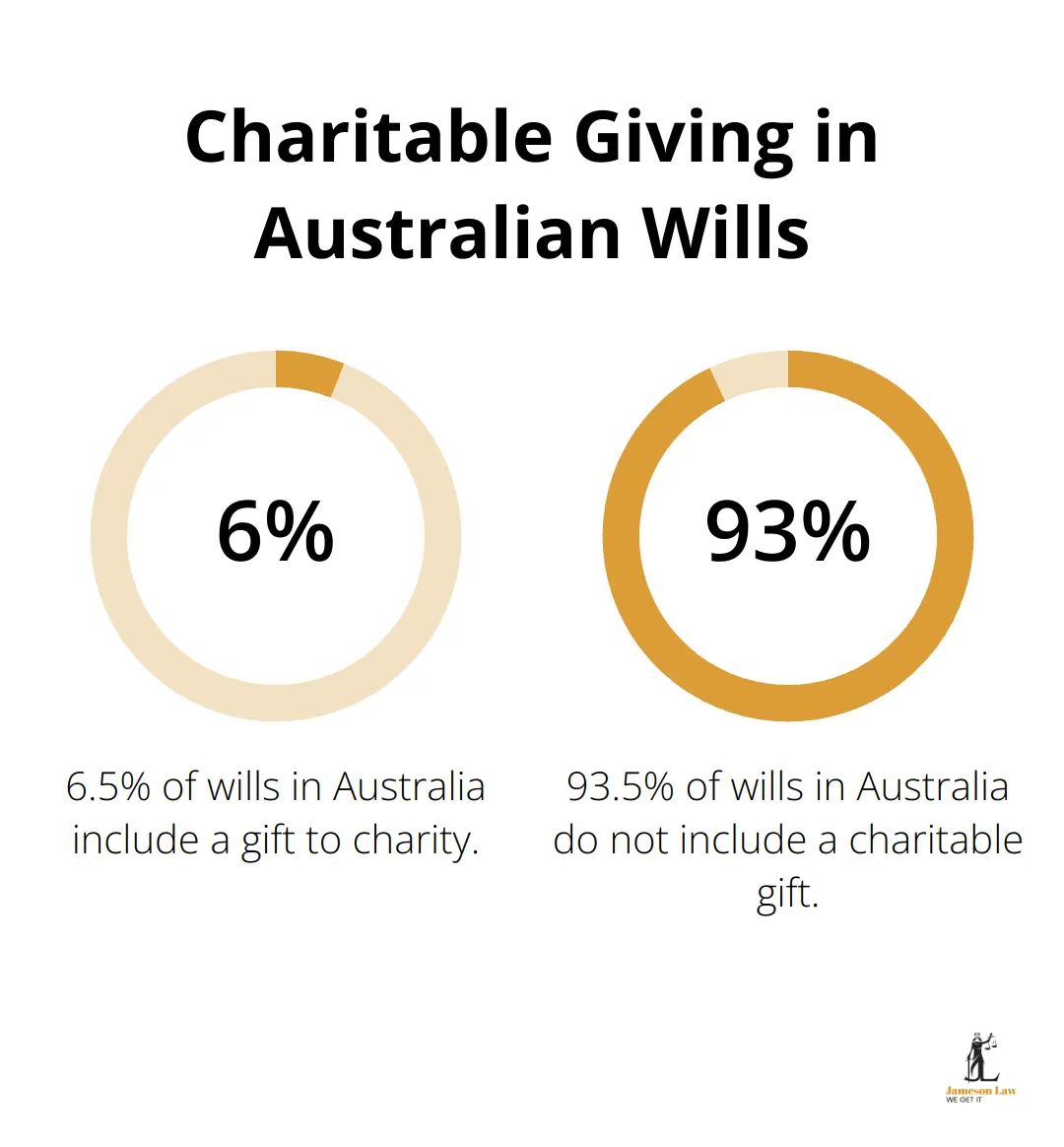

Moreover, a will allows you to make specific bequests to charities or individuals outside your immediate family. Recent data shows that roughly 6.5% of wills in Australia include a gift to charity, demonstrating the significant impact a will can have on causes you care about.

The Stark Reality of Dying Without a Will

In Australia, dying without a valid will (known as dying intestate) can lead to significant complications for your family and assets. Recent data suggests that more than half of all Australian adults do not have an up-to-date will. This startling statistic means that over half of all Australians risk having their estates distributed according to a rigid formula set by state law, rather than their personal wishes.

When you die intestate, your assets are distributed based on a predetermined formula that may not align with your intentions. For instance, in New South Wales, if you’re married with children, your spouse might receive the first $350,000 of your estate plus one-third of the remainder, with the rest going to your children. This could potentially leave your spouse in a precarious financial situation.

Debunking Common Will Misconceptions

Many Australians hold misconceptions about wills that prevent them from taking action. Let’s address some of these myths:

Myth 1: Wills are Only for the Wealthy

In reality, anyone with assets, dependents, or specific wishes for their estate should have a will. Even if you think you don’t own much, you likely have more assets than you realize, including superannuation, life insurance, and personal belongings with sentimental value.

Myth 2: Creating a Will is Complex and Expensive

While it’s true that some wills can be complex (especially for large estates or complicated family situations), many wills are straightforward and can be prepared quickly and affordably with professional help.

Myth 3: I’m Too Young to Need a Will

Life is unpredictable, and having a will in place (regardless of your age) ensures your wishes are respected if the unexpected happens. It’s particularly important if you have dependents or significant assets.

Now that we’ve explored why you need a will, let’s examine the key components of estate planning that go beyond just creating a will.

Key Components of Estate Planning

Asset and Liability Assessment

The foundation of estate planning starts with a thorough evaluation of your financial landscape. This includes identifying all assets (property, vehicles, bank accounts, investments) and liabilities (mortgages, loans, credit card debts). The Australian Securities and Investments Commission (ASIC) reports that many Australians underestimate their estate value by overlooking less obvious assets like superannuation and life insurance policies.

A comprehensive assessment allows for more effective distribution strategies and ensures your estate plan accurately reflects your financial situation. It’s not just about what you own, but also what you owe – these debts will need settlement before any distributions to beneficiaries.

Executor and Trustee Selection

Choosing who will manage your estate is a critical decision. Your executor carries out the instructions in your will, while trustees manage any established trusts. These roles demand trustworthiness, financial acumen, and the ability to handle complex situations.

An Executor ensures your wealth is protected and distributed properly. As part of your Will, you need to appoint an executor to manage and distribute your estate according to your wishes.

Beneficiary Considerations

Estate planning extends beyond simply deciding “who gets what”. It’s essential to consider each beneficiary’s unique circumstances. Do they have special needs? Are they financially responsible? Might they face future relationship breakdowns?

For young children, you might establish a trust for education and living expenses until they reach a certain age. For beneficiaries with disabilities, a special disability trust can provide ongoing care without affecting their eligibility for government benefits.

The planning in blended or step families requires careful consideration. This scenario demands key planning strategies to ensure fair distribution and minimize potential conflicts.

Powers of Attorney and Guardianship

Estate planning isn’t limited to post-death arrangements; it also covers scenarios where you might become incapacitated. This is where powers of attorney and guardianship appointments play a vital role.

An enduring power of attorney allows someone to make financial and legal decisions on your behalf if you lose capacity. An enduring guardianship appointment covers medical and lifestyle decisions.

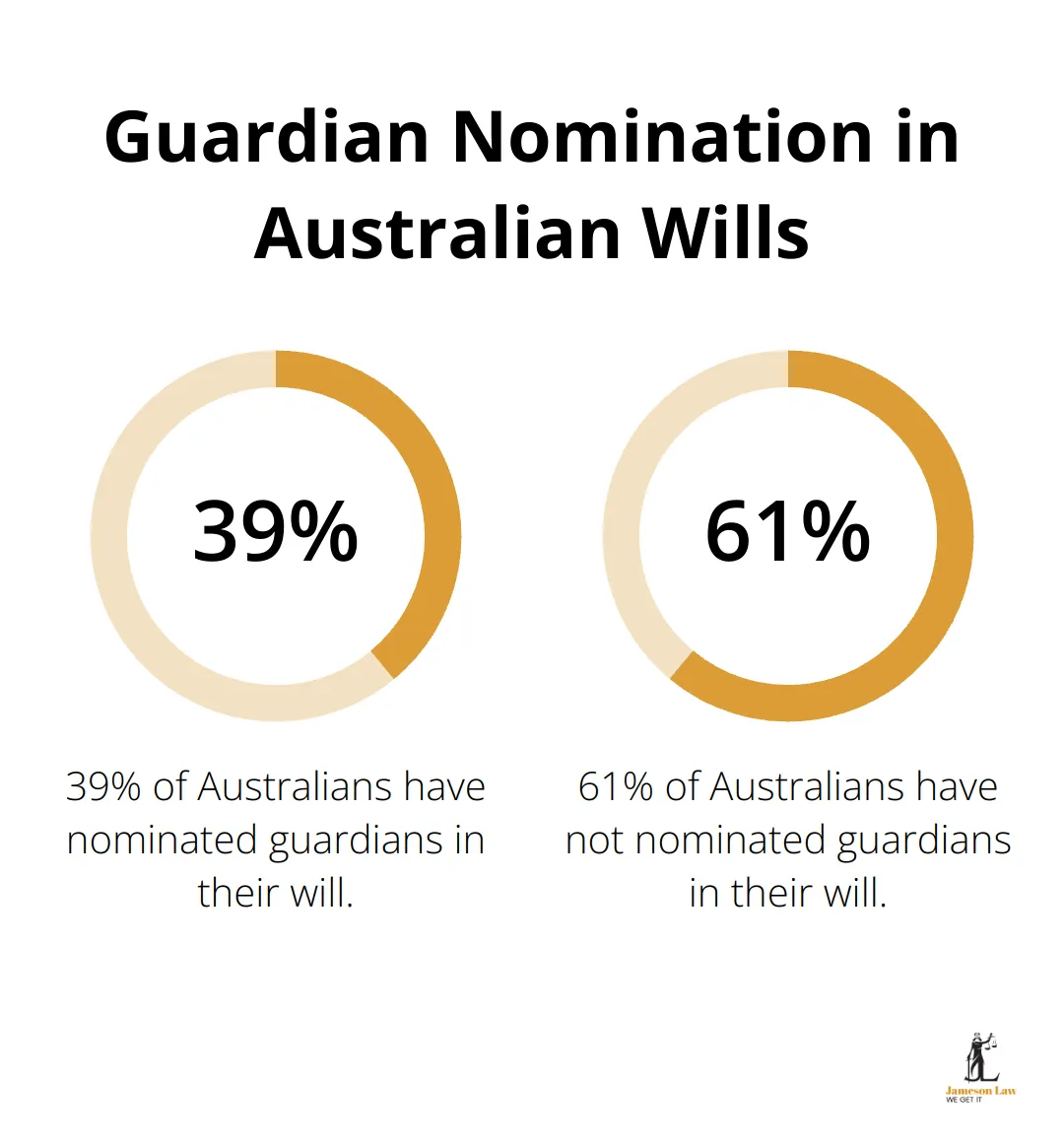

Research indicates that only around 39 per cent have nominated guardians in their will; conversely around 60 percent have not, which represents a significant gap in estate planning preparedness.

As we move forward, it’s clear that estate planning involves more than just drafting a will. The next section will explore advanced strategies to further protect and maximize your estate’s value.

Advanced Estate Planning Techniques

The Power of Testamentary Trusts

Testamentary trusts are powerful tools in estate planning. These trusts come into effect upon death and offer flexibility in asset distribution and tax advantages. Income passing to children under 18 years of age will have penalty rates of tax applied, unless the income is “excepted trust income”.

A testamentary trust can provide ongoing financial support for a child with special needs without affecting their eligibility for government benefits. It can also protect assets from creditors or relationship breakdowns of beneficiaries.

Superannuation Death Benefits

Superannuation is often overlooked in estate planning, yet it’s a significant asset for many Australians.

Super doesn’t automatically form part of your estate. You need to make a valid binding death benefit nomination to ensure your super goes to your intended beneficiaries. If the super fund rules allow a binding death benefit nomination, you can nominate one or more dependants and/or your legal personal representative.

Tax-Effective Estate Planning

Strategic estate planning can significantly reduce the tax burden on your beneficiaries. Capital gains tax (CGT) can be a major consideration. Assets acquired before 20 September 1985 are generally CGT-free, making them valuable for estate planning purposes.

Another strategy involves gifting assets during your lifetime. In Australia, there’s no gift tax, so this can effectively transfer wealth while reducing your taxable estate. However, it’s important to consider the potential impact on aged care fees and pension entitlements.

Philanthropy and Legacy

Incorporating charitable giving into your estate plan can create a lasting legacy while potentially providing tax benefits.

Establishing a private ancillary fund (PAF) allows you to establish your own Charitable Foundation. All donations are tax deductible and all income generated is tax-free. This can allow for ongoing charitable giving, even after death, and can involve family members in philanthropic decisions.

Estate planning is a complex field, and these advanced strategies require careful consideration and expert advice. Working closely with financial advisors and trust lawyers ensures your estate plan is comprehensive, tax-effective, and aligned with your wishes.

Final Thoughts

Estate planning involves more than just creating a will. It requires a thorough evaluation of assets, careful selection of executors, and consideration of beneficiaries’ needs. Advanced techniques like testamentary trusts and tax-effective strategies can enhance your plan’s effectiveness. Regular reviews ensure your estate plan aligns with your current circumstances and goals.

We at Jameson Law urge you to take action today. Don’t leave your legacy to chance. Our wills and estate planning seminar offers valuable insights and practical advice to help you navigate this complex area.

A well-structured estate plan is a thoughtful gift for your loved ones. It invests in their future security and your peace of mind. Take the first step towards securing your legacy by contacting experienced professionals who can guide you through the process.