Estate planning can be a complex process, filled with legal jargon and unfamiliar terms. Understanding these estate planning definitions is essential for making informed decisions about your future and your family’s well-being.

At Jameson Law, we’ve compiled a comprehensive guide to help you navigate the key concepts and documents involved in estate planning. This blog post will break down the fundamental terms, explore different types of trusts, and highlight important legal documents you should know about.

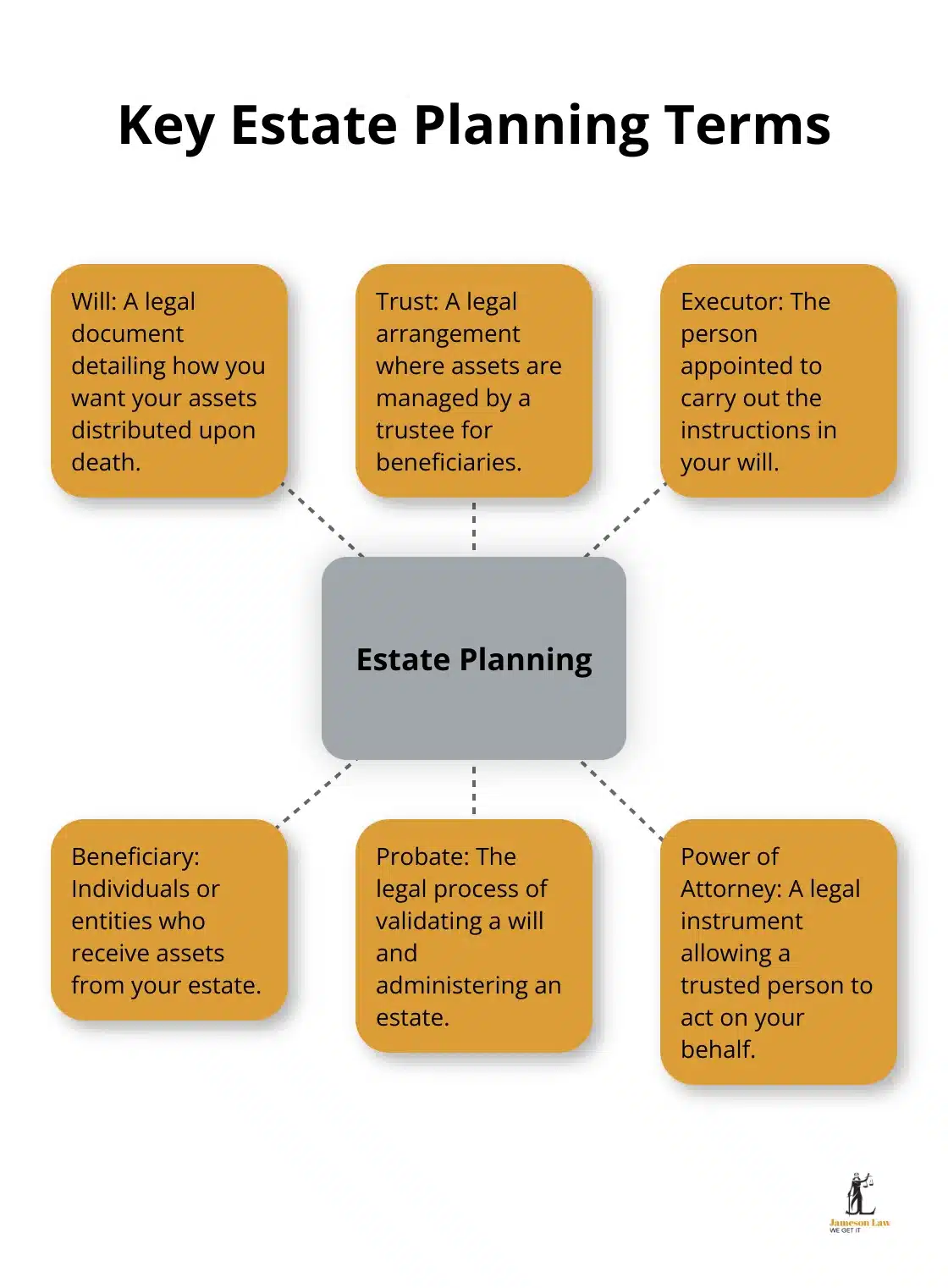

What Are the Key Estate Planning Terms?

Estate planning involves several important terms that everyone should understand. Many clients are unfamiliar with these concepts, which can lead to confusion and potential mistakes in their estate plans.

Will: The Foundation of Your Estate Plan

A will is a legal document detailing whom and how you want your assets to be distributed upon your death. It must nominate a person or persons (“Executor”) to carry out your wishes. In Australia, many adults don’t have a valid will, which can complicate matters for your loved ones.

Your will should name an executor, list your assets, and specify who will receive what. It’s not just for the wealthy – anyone with assets or dependants should have a will. You should update your will regularly, especially after major life events like marriage, divorce, or the birth of a child.

Trust: Protecting and Managing Your Assets

A trust is a legal arrangement where you transfer assets to a trustee, who manages them for the benefit of your chosen beneficiaries. Trusts can offer tax benefits, protect assets from creditors, and provide for minors or individuals with special needs.

In Australia, family trusts are particularly popular. One of the most significant advantages of family trusts in Australia is their tax efficiency. However, trust taxation can be complex, and professional advice is often necessary.

Executor and Beneficiary: Key Roles in Your Estate Plan

An executor is the person you appoint to carry out the instructions in your will. They have significant responsibilities, including gathering assets, paying debts, and distributing property to beneficiaries. You should choose a trustworthy and capable executor for the smooth administration of your estate.

Beneficiaries are the individuals or entities who receive assets from your estate. They can be family members, friends, charities, or even pets (through a pet trust). You should clearly identify your beneficiaries to avoid potential disputes.

Probate and Power of Attorney: Legal Processes and Protections

Probate is the legal process of validating a will and administering an estate. Understanding probate can help you plan strategies to minimise its impact on your beneficiaries.

Power of Attorney (POA) is a vital legal instrument allowing a trusted person to act on your behalf in financial, personal, or medical matters. There are different types of POA, including financial and medical. In Australia, each state has its own POA laws, so it’s important to consult with a local expert to ensure your POA is valid and comprehensive.

Understanding these fundamental estate planning terms is the first step towards creating a robust plan for your future. However, estate planning is complex and highly personal. Professional legal advice can ensure your estate plan accurately reflects your wishes and complies with Australian law.

Now that we’ve covered the basic terms, let’s explore the different types of trusts used in estate planning and how they can benefit your overall strategy.

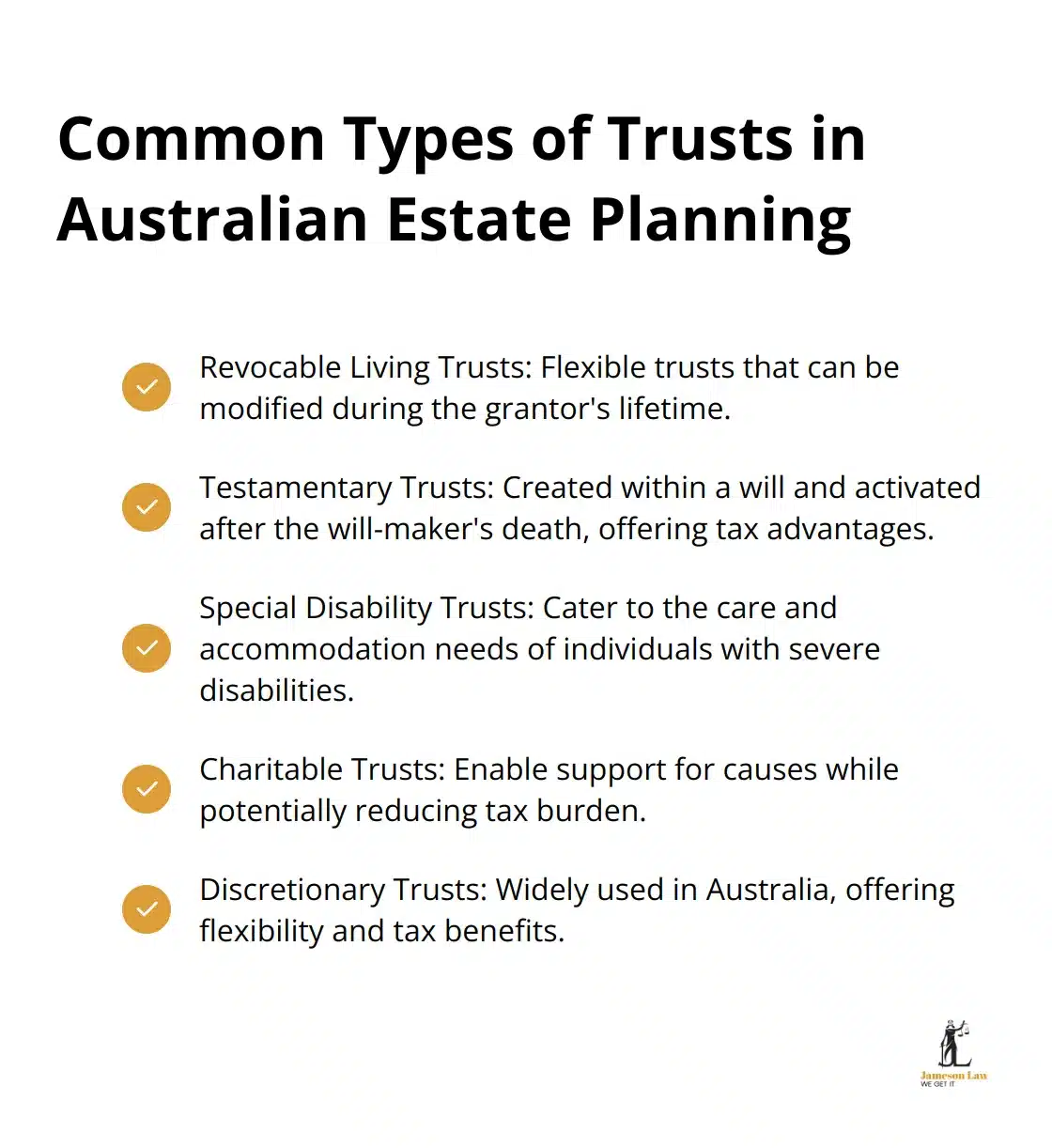

Types of Trusts in Australian Estate Planning

Trusts form a cornerstone of effective estate planning in Australia, offering diverse benefits tailored to specific needs and circumstances. This chapter explores the most common types of trusts used for estate planning purposes in Australia and their unique advantages.

Revocable Living Trusts

Revocable living trusts provide flexibility in estate planning, allowing you to maintain control of your assets during your lifetime. You can modify or revoke these trusts at any time, adapting them to changing circumstances. While less common in Australia due to our tax laws, these trusts can still prove useful for privacy and probate avoidance in certain situations.

Testamentary Trusts

Testamentary trusts, created within a will and activated after the will-maker’s death, have gained popularity in Australia due to their tax advantages. The Australian Taxation Office allows income distributed to minor beneficiaries from a testamentary trust to be taxed at adult rates, potentially resulting in significant tax savings. This makes testamentary trusts an excellent option for parents who want to provide for their children while minimising tax liabilities.

Special Disability Trusts

Special Disability Trusts cater to the care and accommodation needs of individuals with severe disabilities. These trusts offer substantial social security and tax concessions. As of 1 July 2023, this limit is $781,250. This exemption allows the beneficiary to maintain their eligibility for the Disability Support Pension, a significant advantage for families planning long-term care for disabled family members.

Charitable Trusts

Charitable trusts enable you to support causes you care about while potentially reducing your tax burden. In Australia, donations to registered charities are tax-deductible. Establishing a Private Ancillary Fund (PAF) can provide ongoing benefits to charities while offering tax advantages to the donor. Australian Taxation Office data for 2022 shows PAFs and PuAFs distributed $870 million and $401 million respectively, highlighting their growing popularity as an estate planning tool.

Discretionary Trusts

Discretionary trusts (also known as family trusts) see widespread use in Australia due to their flexibility and tax benefits. These trusts allow the trustee to distribute income and capital at their discretion among a group of beneficiaries. Trusts are an essential tool for intergenerational wealth transfer due to their flexibility and ability to provide control, asset protection, and tax benefits.

When selecting a trust structure for your estate plan, professional advice becomes invaluable. The right trust can significantly enhance your estate plan, providing tax benefits, asset protection, and peace of mind for you and your beneficiaries. In the next chapter, we will explore the important legal documents that complement these trust structures in a comprehensive estate plan.

Essential Legal Documents for Estate Planning

Last Will and Testament: The Foundation of Your Estate Plan

Your Last Will and Testament is an important family, social, economic, and legal document. It outlines how you want your assets distributed after your death and names an executor to manage this process. However, some people die without a valid will, and many wills that are written are later contested.

To create a valid will in Australia, you must be at least 18 years old and of sound mind. The will must be in writing and signed by you and two witnesses. You should review and update your will regularly, especially after major life events like marriage, divorce, or the birth of a child.

Enduring Power of Attorney: Planning for Incapacity

An Enduring Power of Attorney (EPOA) allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated. This document remains valid even if you lose mental capacity.

In Australia, each state and territory allows for the appointment of an enduring power of attorney. However, there are variations between Australian states and territories. You should choose someone you trust implicitly for this role, as they will have significant control over your affairs.

Advance Care Directives: Specifying Your Healthcare Preferences

An Advance Care Directive (sometimes called a living will) allows you to specify your preferences for future medical treatment. This document comes into effect if you’re unable to make or communicate decisions about your healthcare.

Only 15% of Australians have an Advance Care Directive. This low uptake means many Australians risk receiving medical care that doesn’t align with their wishes. An Advance Care Directive ensures your healthcare preferences are respected, even if you can’t communicate them yourself.

Superannuation Death Benefit Nominations: Protecting Your Retirement Savings

Superannuation is often one of the largest assets in an Australian’s estate, yet many people overlook it in their estate planning. Your super doesn’t automatically form part of your estate and isn’t governed by your will. You need to make a death benefit nomination to specify who should receive your super when you die.

There are two types of nominations: binding and non-binding. A binding nomination (if valid) must be followed by the super fund trustee. These nominations typically expire after three years unless renewed. Non-binding nominations serve as a guide for the trustee, who ultimately decides how to distribute your super.

Creating these essential legal documents is a critical step in comprehensive estate planning. However, estate law can be complex and varies by state. Professional legal advice can ensure your documents are valid, up-to-date, and truly reflect your wishes.

Final Thoughts

Estate planning definitions form the foundation of a comprehensive strategy to protect your assets and provide for your loved ones. From wills and trusts to powers of attorney and advance care directives, each component plays a vital role in ensuring your wishes are respected. Understanding these terms empowers you to make informed decisions about your future and your family’s well-being.

Professional legal advice can help you navigate the complexities of estate law, which often varies between Australian states and territories. At Jameson Law, we offer expert guidance in wills and estates to create a robust plan that accurately reflects your wishes. Our experienced lawyers can assist you in crafting an estate plan that protects your assets and minimises tax liabilities.

Estate planning is an ongoing process that requires regular review and updates to adapt to changing circumstances. You should review your estate plan after major life events such as marriage, divorce, or the birth of a child. Professional advice can ensure your plan remains current and effective, providing peace of mind for you and your family.