Boating accidents can lead to serious injuries, leaving many wondering: does boat insurance cover personal injury? At Jameson Law, we often encounter this question from boat owners seeking clarity on their insurance coverage.

Understanding the extent of personal injury protection in your boat insurance policy is vital for safeguarding yourself and your passengers on the water. Let’s explore the various aspects of boat insurance and how they relate to personal injury coverage.

What Does Boat Insurance Cover?

Standard Coverage

Boat insurance policies in Australia offer various forms of protection tailored to vessel owners’ needs. Most policies cover damage to your boat, theft, and liability for injuries or property damage you might cause while operating your vessel.

A typical boat insurance policy includes protection for accidental damage, fire, and theft. If your boat suffers damage in a collision, catches fire, or gets stolen, you’re likely covered. Many policies also protect your boat’s trailer and any permanently attached equipment.

Comprehensive private vessel insurance should cover you for loss or damage to your vessel, including accidental damage, fire, theft, and malicious damage.

Personal Injury Protection

Personal injury protection forms a significant part of most boat insurance policies. This usually includes third-party liability coverage, which can pay for injuries you cause to others while operating your boat. Some policies also offer limited medical payment coverage for you and your passengers.

Optional Add-ons

Boat owners seeking extra protection can choose from several optional add-ons. These may include coverage for personal effects, fishing equipment, and emergency assistance. Some insurers offer lay-up coverage, providing a discount for periods when your boat is not in use.

The Importance of Adequate Coverage

The impact of inadequate insurance coverage in boating accident cases can be severe. It’s essential to thoroughly review your policy and consider your specific needs when choosing coverage.

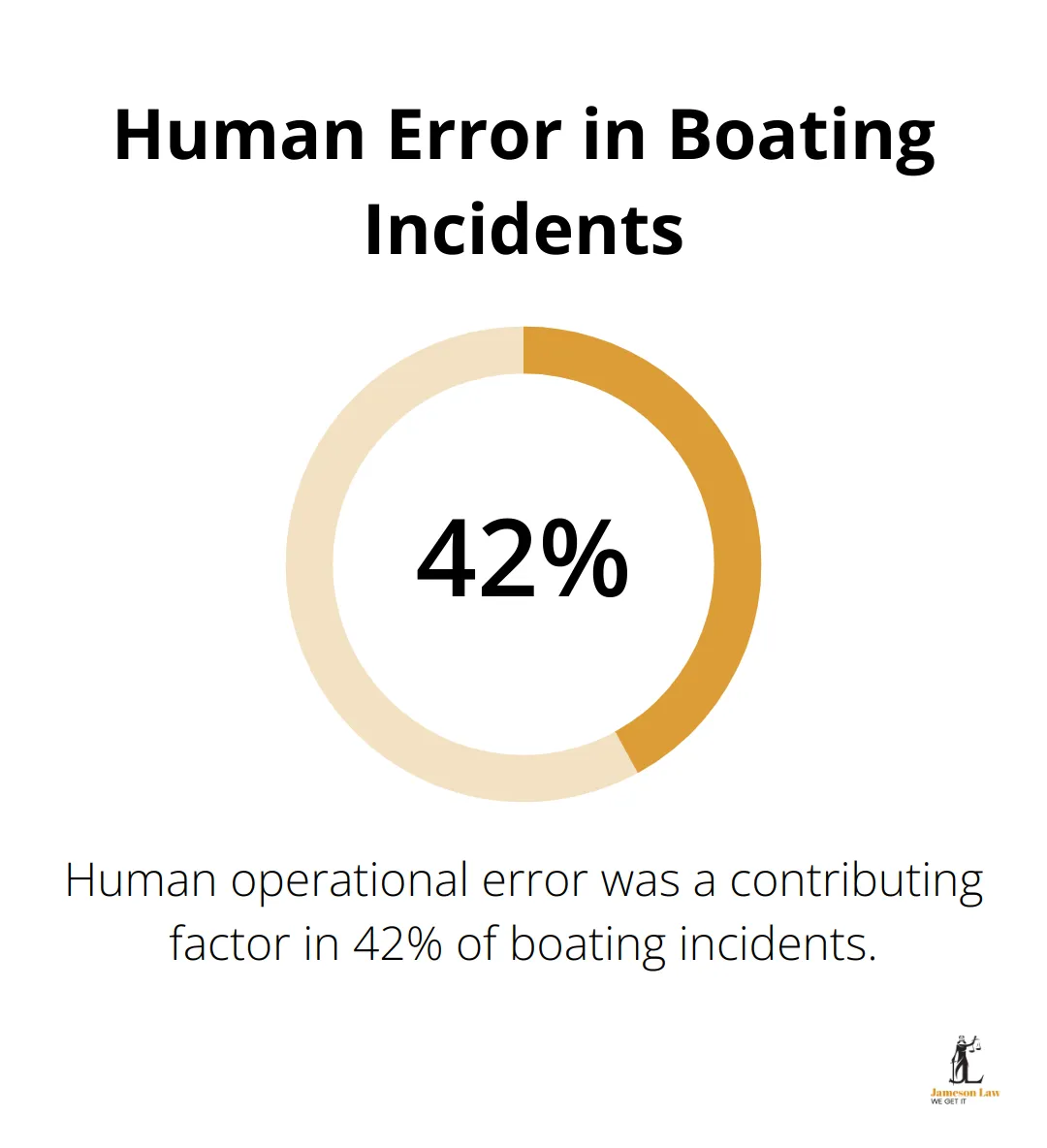

While boat insurance provides vital protection, safe boating practices are equally important. The Australian Maritime Safety Authority reports that human operational error was a contributing factor in 42% of incidents. This statistic emphasizes the need for both insurance and responsible vessel operation.

As we move forward, let’s examine how boat insurance specifically addresses personal injury coverage and what factors can affect this crucial aspect of your policy.

How Does Boat Insurance Cover Personal Injury?

Third-Party Liability Coverage

Most boat insurance policies include third-party liability coverage. This protects you financially if you’re responsible for injuring someone else while operating your boat. For example, if you accidentally collide with another vessel and injure its occupants, your insurance would cover their medical expenses and potential legal costs.

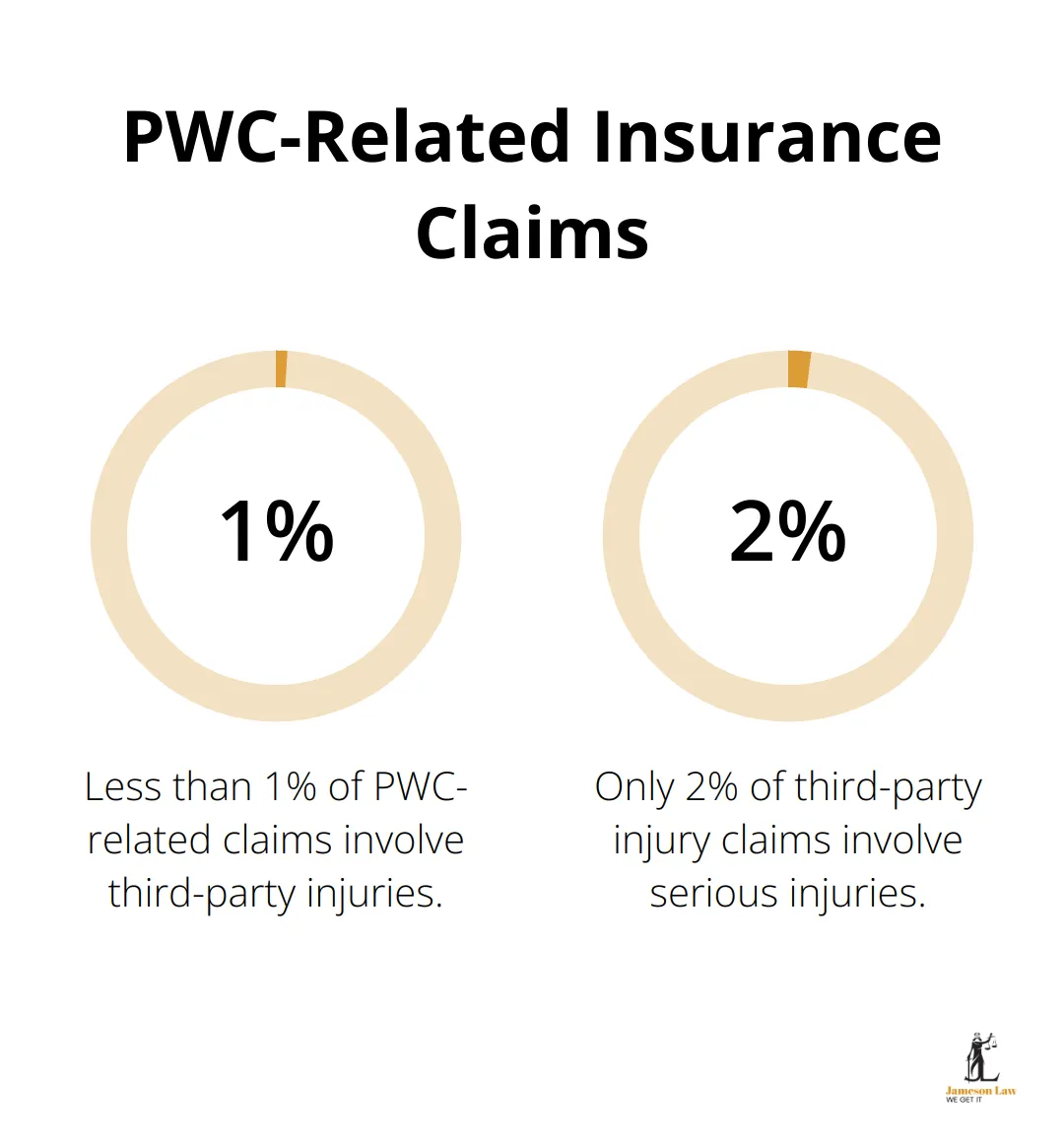

Club Marine has recorded that less than 1% of its PWC-related claims involve third-party injuries, and only a small proportion – 2% – of these claims involve serious injuries.

Medical Payments Coverage

Some boat insurance policies offer medical payments coverage. This covers medical expenses for you and your passengers if injured while on your boat, regardless of who’s at fault. It’s important to note that this coverage often has limits and may not be included in all policies.

Coast Insurance notes that if your boat is insured for $100,000, there could be a separate $1,000,000 limit available to cover the reasonable costs of medical expenses.

Uninsured Boater Coverage

Uninsured boater coverage is an optional add-on that protects you if you’re injured by another boater who doesn’t have insurance. Given that boat insurance isn’t compulsory in most parts of Australia, this coverage can be essential.

To manage the risk of cover being taken out on an uninsured Boat or increasing cover on underinsured items when events such as cyclones, floods or bushfires are imminent, some insurers may place an embargo on new policies or increases in cover.

Policy Limits and Exclusions

When you review your boat insurance policy, pay close attention to the coverage limits and any exclusions. Some policies may not cover injuries resulting from certain activities (such as water skiing or racing). Others might have geographical limitations, only covering incidents within a certain distance from the shore.

It’s also worth noting that most policies won’t cover injuries if you operated the boat under the influence of alcohol or drugs. The Australian Maritime Safety Authority reports that alcohol was a factor in 23% of boating fatalities in 2021, highlighting the importance of responsible boating.

Understanding Your Coverage

We recommend you thoroughly review your policy and discuss any concerns with your insurance provider. Understanding your coverage ensures you’re adequately protected on the water and can enjoy boating with peace of mind.

As we move forward, let’s examine the factors that can affect personal injury coverage in your boat insurance policy and how they might impact your protection on the water.

What Affects Personal Injury Coverage in Boat Insurance?

Personal injury coverage in boat insurance depends on several factors. Boat owners must understand these elements to ensure they have adequate protection.

Policy Limits and Deductibles

The amount of coverage for personal injuries directly ties to policy limits. These limits set the maximum payout from your insurer for a claim. For example, a $500,000 limit for personal injury liability means your insurer won’t pay more than this amount, regardless of actual costs.

Deductibles also impact coverage. This out-of-pocket expense precedes insurance activation. Higher deductibles often result in lower premiums but increase your financial responsibility for claims.

Geographical Restrictions

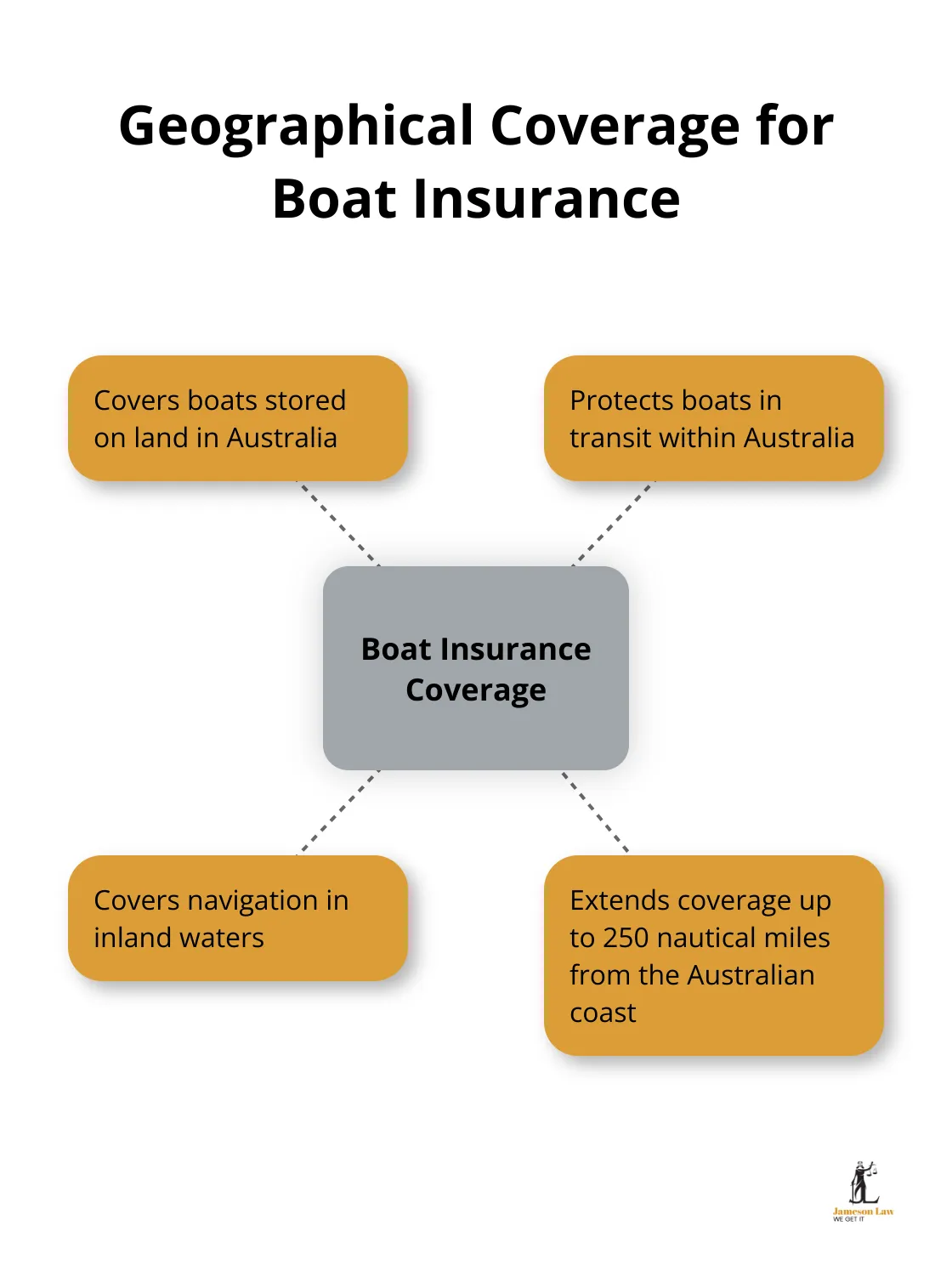

Many boat insurance policies include geographical limitations. Your policy might only cover incidents within a certain distance from the Australian coastline.

Geographic limits typically provide cover for your boat while it’s stored on land or in transit in Australia, and while navigating inland or up to 250 nautical miles from the Australian coast.

Some policies may also offer different coverage levels for inland waterways versus coastal waters. It’s essential to match your policy’s geographical coverage to your boating habits.

Policy Exclusions and Restrictions

Insurance policies often contain exclusions and restrictions that limit personal injury coverage. Common exclusions include:

- Injuries from illegal activities

- Injuries to paid crew members

- Injuries during racing events

Some policies also restrict coverage based on boat use. For instance, coverage might differ between occasional fishing and commercial charter operations.

Boat Type and Value

The type and value of your boat can significantly influence your personal injury coverage. Larger, more expensive boats often require higher coverage limits due to increased risk and potential liability.

Operator Experience and Training

Some insurers consider the experience and training of the primary boat operator when determining coverage. Completion of boating safety courses or a history of safe boating can sometimes result in more comprehensive coverage or lower premiums.

Final Thoughts

Boat insurance policies often cover personal injury, but the extent of coverage varies. You must review your policy regularly to ensure it meets your current needs. The maritime environment changes, and what sufficed last year might not protect you adequately now.

Insurance professionals who specialise in marine policies can provide valuable insights. They can help you understand your coverage, identify gaps, and suggest adjustments for comprehensive protection. Adequate personal injury coverage allows you to focus on enjoying your boating experience without worrying about potential financial consequences.

For expert legal advice on personal injury matters related to boating accidents, Jameson Law offers comprehensive support. The right boat insurance policy (combined with safe boating practices) forms your best defence against the unexpected. Stay informed and covered to enjoy your time on the water with confidence.