Financial distress can strike any business, leaving owners and directors grappling with complex legal challenges.

At Jameson Law, we understand the critical role an insolvency lawyer in Sydney plays in guiding companies through these turbulent times.

This post explores the legal landscape of business insolvency in Sydney, outlining key options and highlighting the vital support an experienced insolvency lawyer provides.

Understanding Business Insolvency in Sydney

Defining Insolvency Under Australian Law

In Sydney’s dynamic business environment, company owners and directors must grasp the concept of insolvency. Australian law defines a business as insolvent when it cannot pay its debts as they become due. This straightforward definition carries weighty legal and financial consequences for Sydney businesses.

The Sydney Business Insolvency Landscape

Sydney’s competitive market presents unique challenges. High operational costs, including steep commercial rents and wages, can push businesses towards insolvency. The Australian Securities and Investments Commission (ASIC) identifies poor strategic management and inadequate cash flow as primary causes of business failures in NSW.

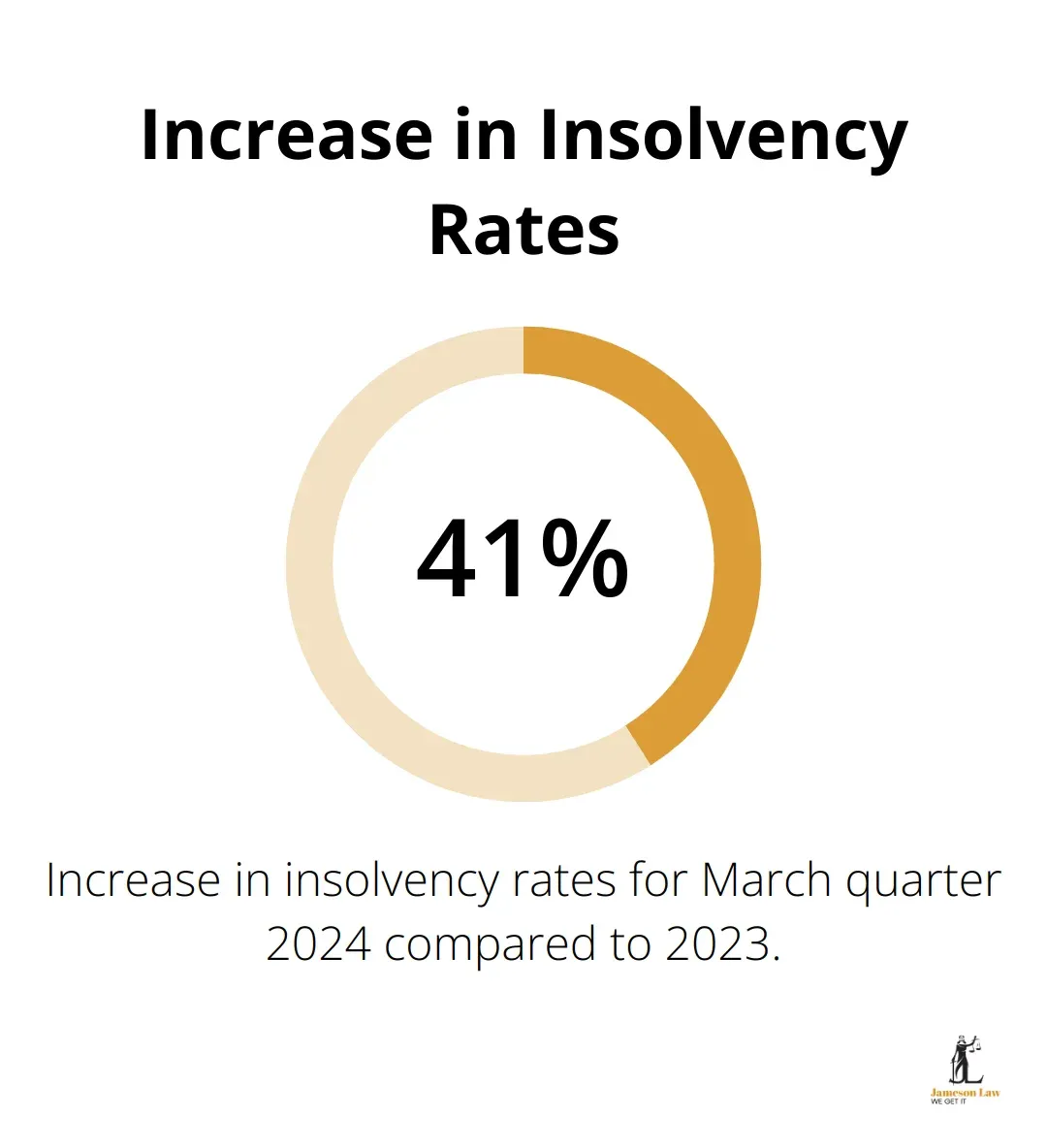

Recent data reveals a 41.1% increase in insolvency rates for the March quarter 2024 compared to the same period in 2023. This uptick underscores the ongoing financial pressures Sydney businesses face.

Common Triggers of Insolvency in Sydney

Sydney businesses often struggle with:

- Rapid expansion without adequate capital

- Loss of major clients or contracts

- Unexpected market downturns

- Regulatory changes affecting business models

The construction industry in Sydney has shown particular vulnerability, with several high-profile insolvencies in recent years.

Early Warning Signs of Insolvency

Businesses should watch for these key indicators:

- Consistently late payments to suppliers

- Difficulty meeting tax obligations

- Reliance on credit to cover operational costs

- Declining sales or profit margins

ASIC data shows that inadequate cash flow is a primary cause of companies entering external administration in NSW. This fact emphasises the importance of robust financial management and early intervention.

COVID-19’s Impact on Sydney Businesses

The pandemic has left an indelible mark on Sydney’s business landscape. While government support measures initially suppressed insolvency rates, a rebound now occurs.

Understanding these trends and causes forms the first step in addressing potential insolvency. For Sydney businesses facing financial strain, expert legal advice (sought early) can make the difference between recovery and closure. As we move forward, let’s explore the legal options available to insolvent businesses in Sydney, providing a roadmap for those navigating these challenging waters.

Navigating Legal Options for Sydney Businesses in Crisis

When a Sydney business faces insolvency, swift action and expert guidance become essential. The legal landscape offers several pathways for companies in financial distress, each with its own implications and potential outcomes.

Voluntary Administration: A Lifeline for Struggling Businesses

Voluntary administration serves as a powerful tool for Sydney companies facing financial turmoil. This process allows businesses to temporarily pause most creditor actions while an independent administrator assesses the company’s future.

The process typically unfolds over 20-25 business days. During this time, the administrator explores three main options:

- Return the company to directors’ control

- Enter a deed of company arrangement

- Proceed to liquidation

For many Sydney businesses, voluntary administration offers a chance to restructure and emerge stronger.

Liquidation: When Winding Up Becomes Necessary

Sometimes, liquidation becomes the most viable option for insolvent Sydney businesses. This process involves selling company assets to repay creditors and ultimately dissolve the business.

Liquidation can take two forms:

While often seen as a last resort, liquidation can provide a structured way to wind up affairs and potentially shield directors from personal liability for insolvent trading.

Debt Restructuring: Crafting a Path to Financial Recovery

For Sydney businesses with manageable debt levels, restructuring agreements offer a chance to negotiate with creditors and avoid more drastic measures. These agreements can take various forms, including informal arrangements with creditors or formal debt agreements under Part IX of the Bankruptcy Act.

The key to successful restructuring lies in early action and transparent communication with creditors. Sydney businesses that proactively address financial challenges often find creditors more willing to negotiate favourable terms.

Small Business Restructuring: A Tailored Approach

In 2021, the Australian government introduced the small business restructuring process, designed specifically for businesses with liabilities under $1 million. This streamlined process aims to help small businesses restructure their debts while allowing directors to retain control of the company.

The small business restructuring process offers:

- A 20-business day period to develop a restructuring plan

- Continued trading under existing management

- Protection from unsecured and some secured creditors

This option provides a valuable lifeline for smaller Sydney businesses facing financial difficulties.

As we move forward, it’s important to understand the critical role an insolvency lawyer plays in navigating these complex legal options. Their expertise can make the difference between a successful turnaround and a business closure. Estate planning can also be a crucial consideration for business owners facing financial challenges.

How an Insolvency Lawyer Can Help Your Sydney Business

Comprehensive Financial and Legal Assessment

An insolvency lawyer’s first step involves a thorough evaluation of your business’s financial situation. This includes an analysis of cash flow, assets, liabilities, and potential legal risks. This initial assessment often uncovers options that business owners might have overlooked.

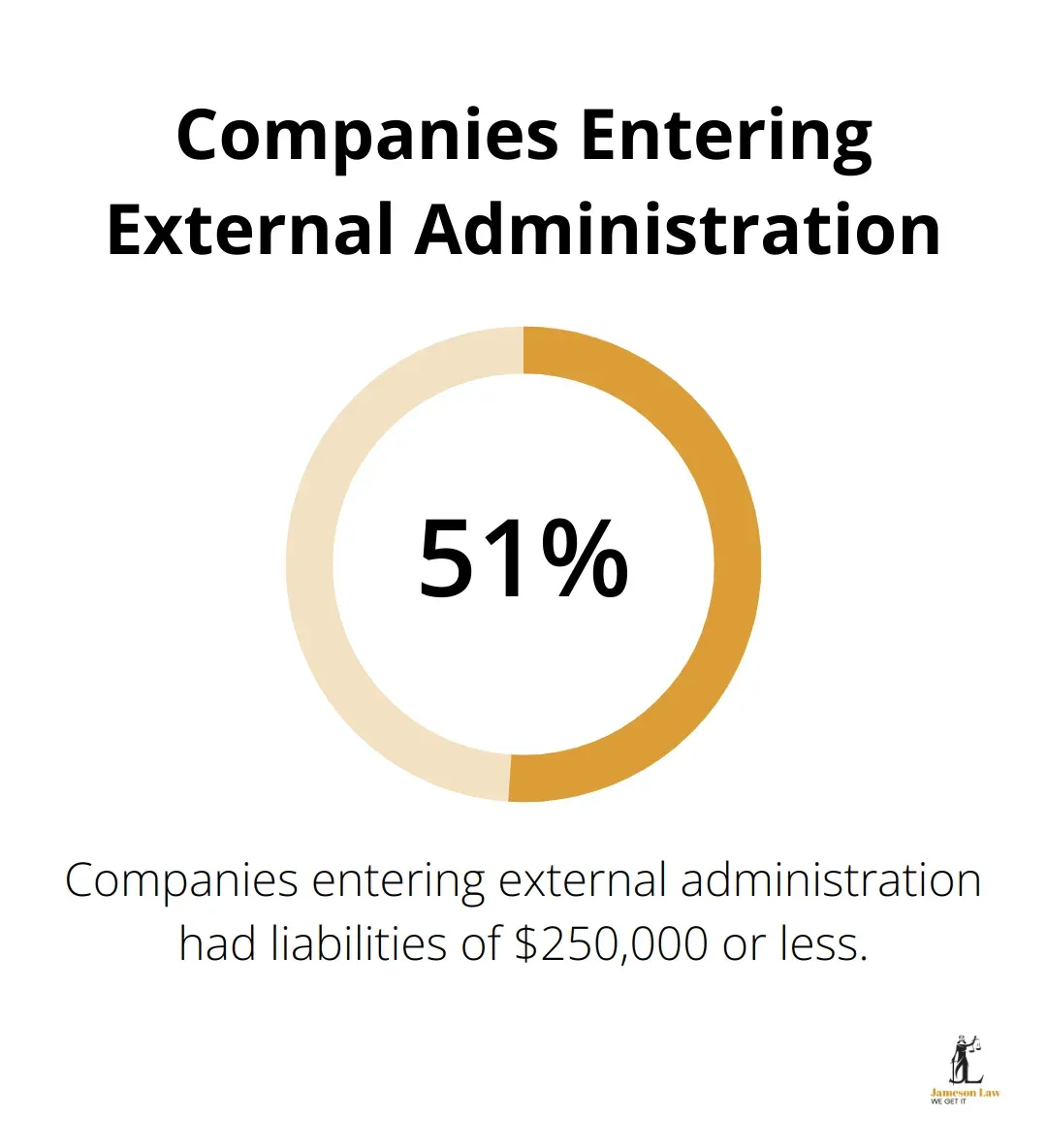

A recent Australian Securities and Investments Commission (ASIC) report revealed that 51% of companies entering external administration had liabilities of $250,000 or less. This statistic highlights how even relatively small debt loads can push businesses into insolvency, emphasising the importance of early legal intervention.

Strategic Creditor Negotiations

One of the most valuable services an insolvency lawyer provides is expert negotiation with creditors. These negotiations can lead to more favourable repayment terms, debt reductions, or even debt forgiveness in some cases.

A skilled lawyer can present your business’s case effectively, often securing better outcomes than if you approached creditors alone. In some cases, lawyers have successfully negotiated significant reductions in outstanding debts for Sydney-based businesses, providing the breathing room needed to restructure and avoid liquidation.

Court Representation and Legal Protection

If your insolvency case reaches the courts, an experienced lawyer becomes essential. They will represent your interests, ensure all legal procedures are followed correctly, and protect your rights.

In NSW, the Supreme Court handles most complex insolvency matters. An insolvency lawyer familiar with this court’s procedures can navigate the process more efficiently (potentially saving you time and money).

Guidance on Directors’ Duties and Liabilities

Directors of insolvent companies face significant legal responsibilities and potential personal liabilities. An insolvency lawyer provides critical advice on these matters, helping directors understand and fulfil their obligations under the Corporations Act 2001.

Directors must be aware of their duty to prevent insolvent trading. Directors face civil penalties for trading while insolvent and are liable for the debts incurred while the company was insolvent. They may also face criminal charges.

An insolvency lawyer can help you understand these risks and take appropriate action to protect both your business and personal assets. This might involve implementing safe harbour provisions or advising on when to appoint voluntary administrators.

Tailored Solutions for Sydney Businesses

Every business faces unique challenges, and an experienced insolvency lawyer will provide tailored solutions. They consider factors such as your industry, business size, and specific financial situation to develop the most effective strategy.

For Sydney businesses, local market knowledge becomes particularly valuable. An insolvency lawyer with experience in the Sydney business landscape can offer insights into industry-specific challenges and opportunities for restructuring or recovery.

Final Thoughts

The complex terrain of business insolvency demands swift action and expert guidance. Financial challenges facing Sydney businesses highlight the importance of professional legal advice at the first signs of financial distress. An insolvency lawyer in Sydney can make the difference between business recovery and closure.

Jameson Law understands the unique pressures facing Sydney businesses. Our team of experienced insolvency lawyers provides tailored solutions to help companies navigate financial difficulties. We offer comprehensive assessments, strategic advice, and robust representation to protect your interests and explore all available options for recovery or restructuring.

Financial challenges should not dictate the future of your business. Many Sydney companies can overcome insolvency threats and emerge stronger with the right legal support. Take the first step towards financial recovery by consulting with an experienced insolvency lawyer today.