Property division after separation affects your financial security for decades. Most people get this wrong because they don’t understand how Australian courts actually assess what’s fair.

We at Jameson Law have guided hundreds of clients through family law property settlements. This roadmap shows you exactly what to expect and how to protect your interests.

How Australian Courts Actually Assess Property Fairness?

The Four-Step Assessment Process

Australian family law does not aim for equal 50/50 splits. Courts apply an assessment process under the Family Law Act 1975. This means a 60/40 or 70/30 split can be entirely fair depending on your situation.

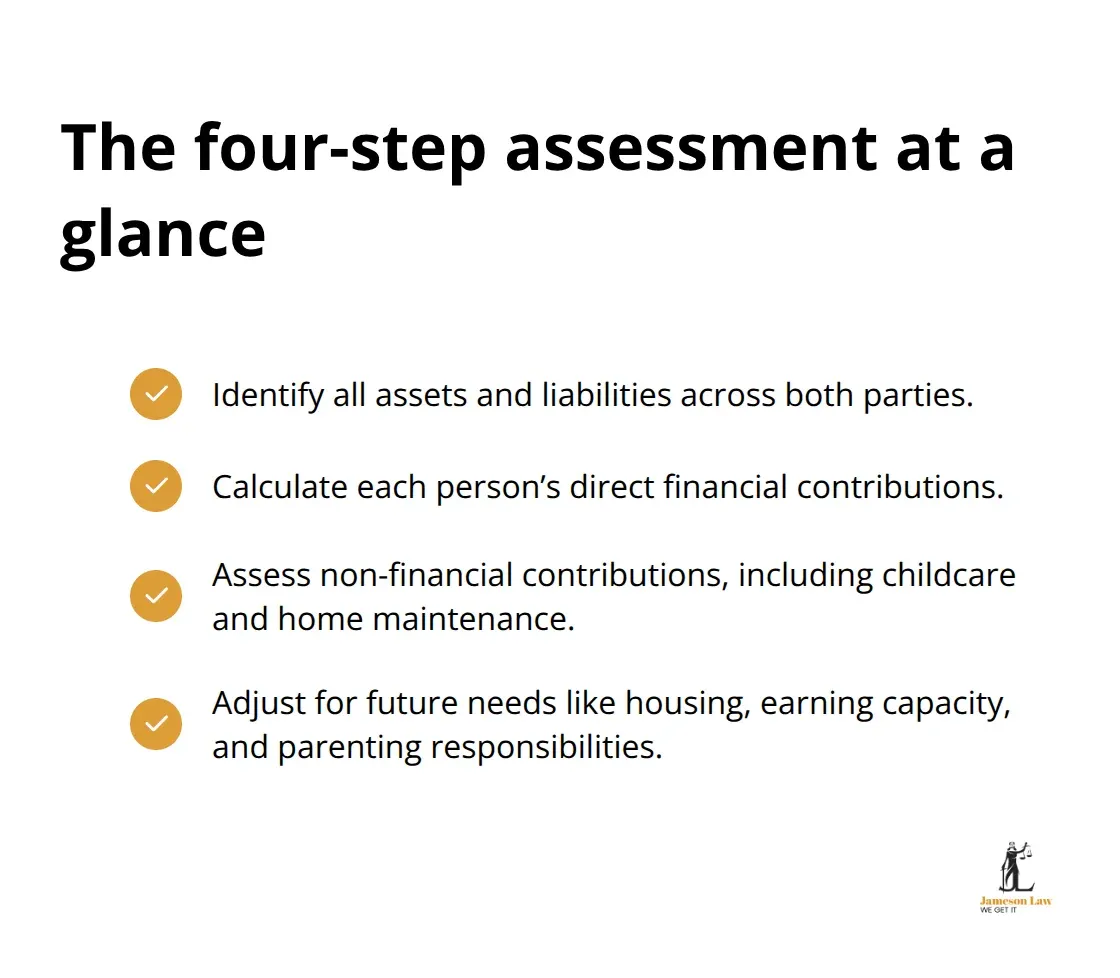

The Federal Circuit and Family Court of Australia follows these steps:

- Identify Property: Real estate, vehicles, superannuation, and debts. Full financial disclosure is mandatory.

- Assess Contributions: Financial (wages) and non-financial (homemaking/parenting).

- Evaluate Future Needs: Factors like age, health, and care of children.

- Just and Equitable: A final check to ensure fairness.

Why Equal Splits Don’t Apply

A parent who sacrificed career progression to raise children has different future needs. If you have ongoing childcare responsibilities, courts recognise you may earn less in future years and adjust accordingly. This is often addressed through the “future needs” adjustment or spousal maintenance.

Superannuation and Hidden Assets

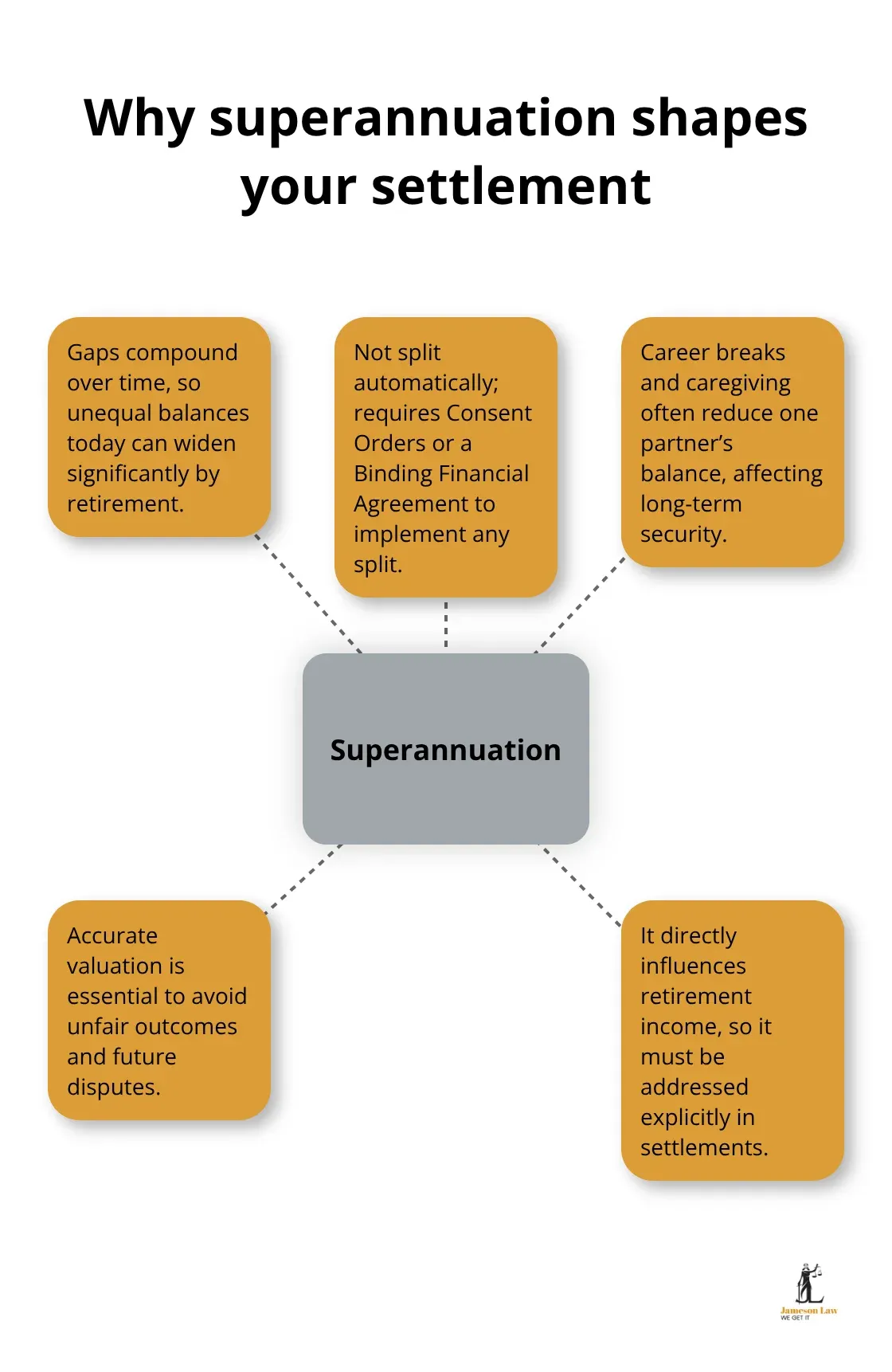

Superannuation is a major asset. It is not automatically split 50/50 and must be specifically addressed. You need formal Consent Orders or a Binding Financial Agreement (BFA) to make splitting legally binding.

Protecting Your Settlement

Formalising your settlement protects both parties. The Attorney-General’s Department provides guidance on structuring these arrangements. Informal agreements are not enforceable.

What Actually Determines Your Settlement Amount?

Direct and Non-Financial Contributions Shape Your Entitlement

Your contributions shape your entitlement. Non-financial contributions, like parenting, carry real weight. The Court explicitly recognises family violence if it impacted your ability to contribute financially.

Superannuation: The Asset Most People Underestimate

If you have differing super balances, that gap compounds over time. You must address superannuation explicitly in your financial agreement. Leaving it unresolved creates significant financial risk.

How to Negotiate Your Settlement Without Wasting Time?

Prepare Your Documentation Before Mediation

Mediation resolves most settlements faster than court. You must collect bank statements, property valuations, and tax returns before you start. Incomplete information derails negotiations.

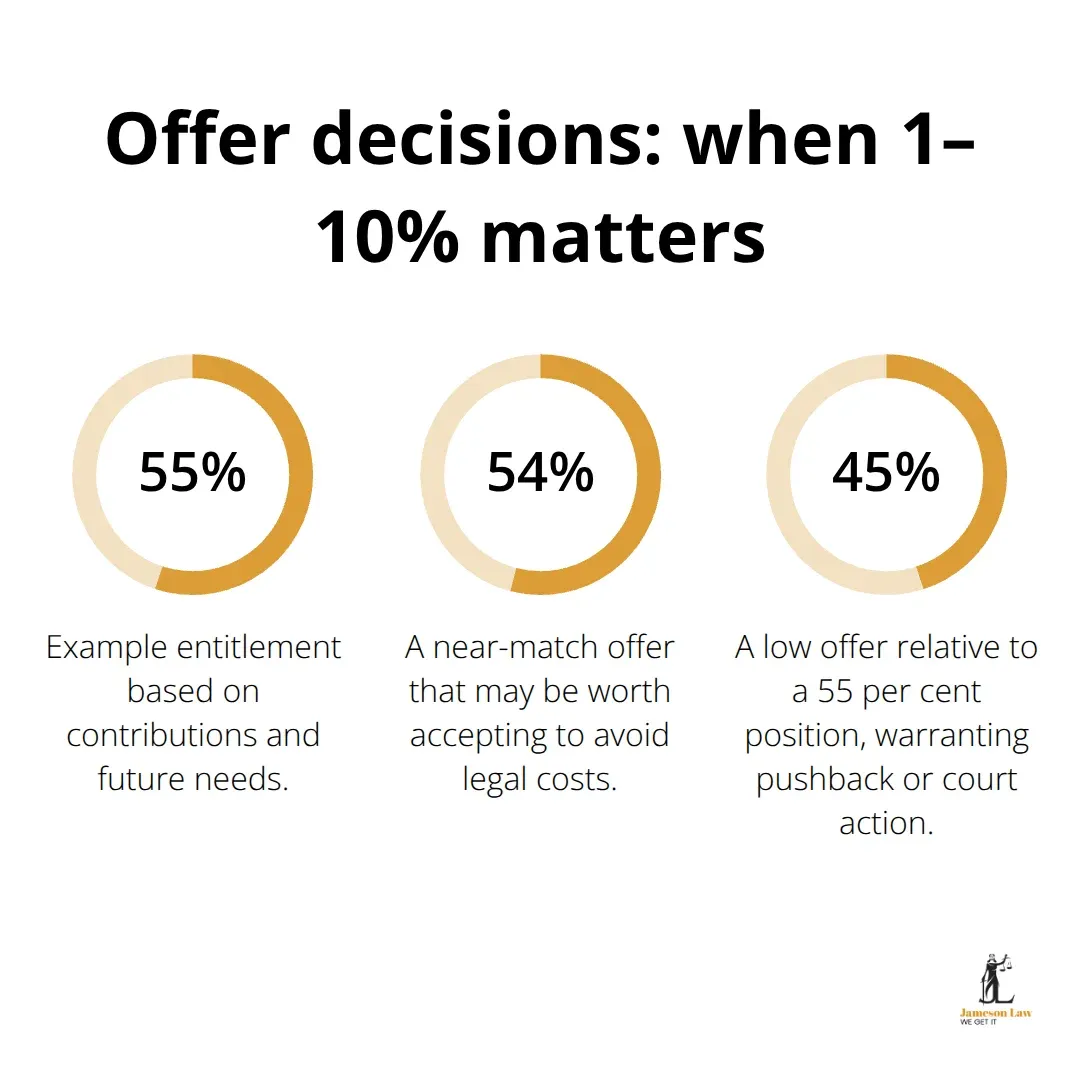

Know When to Accept an Offer

Understand your realistic entitlement based on the 4-step process. If an offer is close to your entitlement, accepting it can save thousands in legal fees. However, do not accept unfair offers just to end the process.

Formalise Your Agreement

Formalising any agreement through Consent Orders makes it legally binding. Never rely on a handshake deal.

Final Thoughts

Family law property settlement shapes your financial future. Understand that courts assess fairness through contributions and future needs, not just equal splits. Gather complete documentation and formalise agreements properly.

We at Jameson Law have seen how early advice prevents costly mistakes. Contact Jameson Law for expert guidance tailored to your situation.