Section 114 of the Family Law Act shapes how property and finances are protected when relationships end. Getting this right matters because mistakes can cost you thousands of dollars if assets are sold before a settlement is reached.

At Jameson Law, we’ve seen families struggle through Section 114 disputes because they didn’t understand their rights from the start. This guide walks you through what Section 114 covers, how it protects your property settlement, and how to secure your financial future.

What Section 114 Actually Covers?

Section 114 of the Family Law Act 1975 gives the court power to issue injunctions that protect assets during family law proceedings. This isn’t about deciding the final split—it’s about stopping one party from emptying bank accounts, selling real estate, or transferring superannuation before a final agreement is reached.

Recognising When Assets Face Real Risk

You need an injunction when objective evidence shows assets face a real risk of dissipation. This includes unusual bank withdrawals or sudden property listings. The Federal Circuit and Family Court of Australia (FCFCOA) weighs whether restricting someone’s freedom to deal with assets is “just and convenient.”

The Timing of Section 114 Applications

Timing matters enormously. Section 114 applies when you’ve started family law proceedings or reasonably anticipate needing them. If your partner mentions moving funds offshore, you must act. Courts have upheld these injunctions to prevent the defeat of future orders.

Protecting Superannuation and Complex Assets

Superannuation requires particular attention. Trustees can act quickly, and recovery is difficult once funds leave the fund. An injunction stops these transfers. Our Sydney family lawyers can act urgently to secure these assets.

How Assets Get Valued and Divided?

Understanding Asset Valuation in Family Law

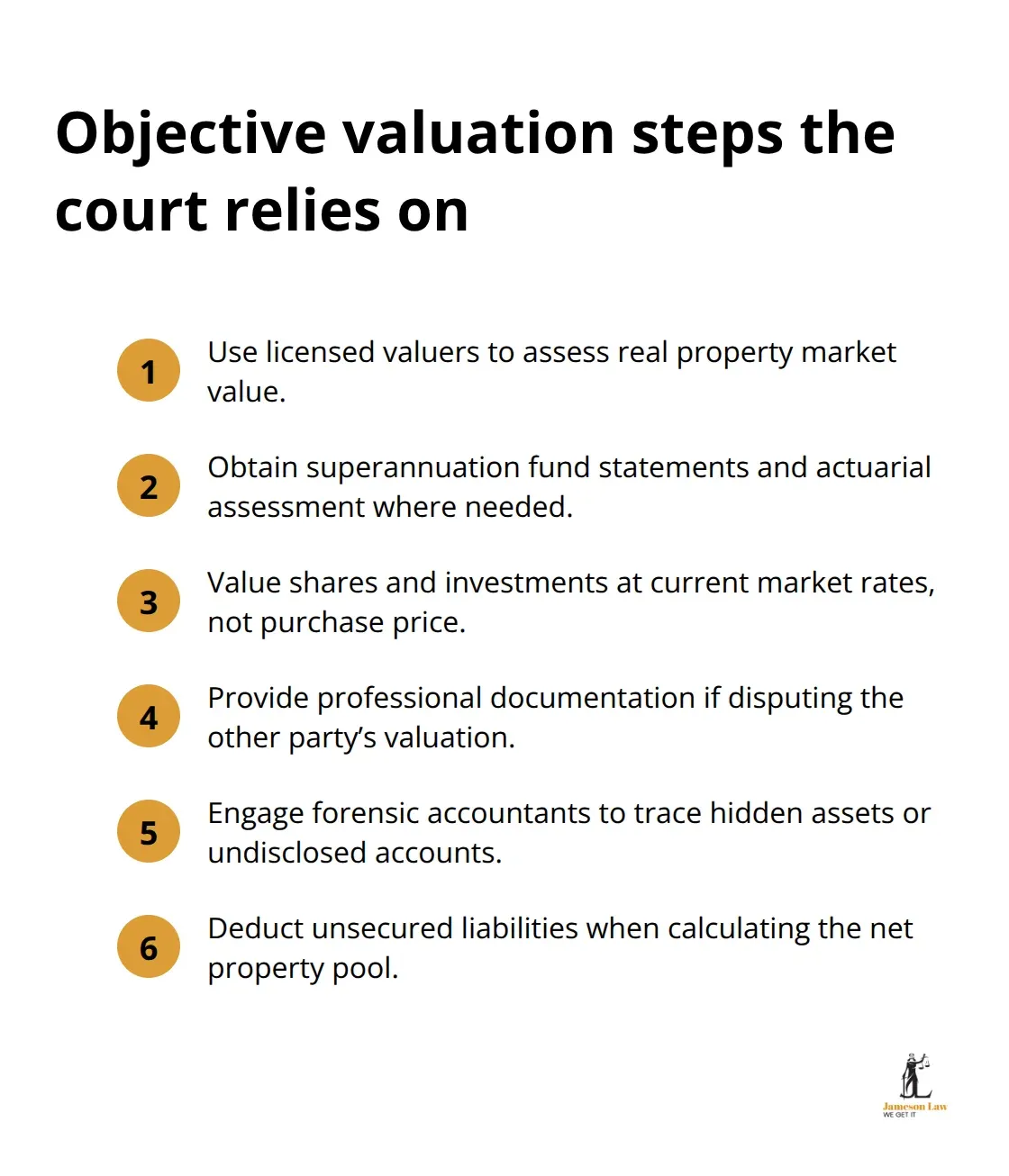

The court examines what you own and what you owe. Real estate requires professional valuation. Superannuation needs actuarial assessment. The court uses objective evidence: licensed valuers for property and current market data for shares. Binding Financial Agreements can help pre-determine these values if signed early.

The Timing and Impact of Valuation Dates

Valuation dates matter because asset values fluctuate. A property valued at the start of proceedings may change value significantly by settlement. Courts generally value assets at the date of the hearing or final agreement.

Spousal Maintenance: A Different Framework

Spousal maintenance operates on a different framework from property division. The court examines income, earning capacity, and living expenses. It is not automatic; one party must demonstrate a need and the other the capacity to pay.

Common Challenges in Asset Disputes

Asset Classification and Hidden Funds

Asset classification disputes cause delays. If inheritance funds are mixed with joint finances, courts treat them as part of the divisible pool. Keep meticulous records. Forensic accountants can help trace funds if you suspect concealment.

Misconduct and Costs Consequences

Courts scrutinise financial conduct. Hiding assets or providing false valuations can lead to adverse costs orders. The court may penalise parties who engage in misleading conduct during financial disclosure.

Final Thoughts

Section 114 of the Family Law Act is a powerful tool to protect your assets, but you must act quickly. We at Jameson Law have watched families lose money because they waited too long to apply for injunctions.

If you suspect your partner is disposing of assets, contact Jameson Law immediately. Professional legal advice makes the difference between a secure settlement and financial vulnerability.