Accidents happen, and when they do, you need to know if your home insurance covers personal injury. At Jameson Law, we often see clients struggling with the complexities of filing claims and dealing with insurance companies.

This guide will walk you through the process of handling personal injury claims with home insurance, helping you navigate potential challenges and understand your rights.

What Does Home Insurance Cover for Personal Injuries?

Home insurance policies often include coverage for personal injuries, but many homeowners don’t know the specifics. Understanding what’s covered can make a significant difference when accidents occur on your property.

Types of Personal Injuries Covered

Most home insurance policies in Australia cover injuries that occur on your property due to your negligence. This can include slip and fall accidents, dog bites, or injuries from falling objects. If a visitor trips on a loose floorboard or a falling tree branch injures them, your home insurance might cover their medical expenses and potential legal costs.

It’s important to note that intentional injuries or those caused by gross negligence are typically not covered.

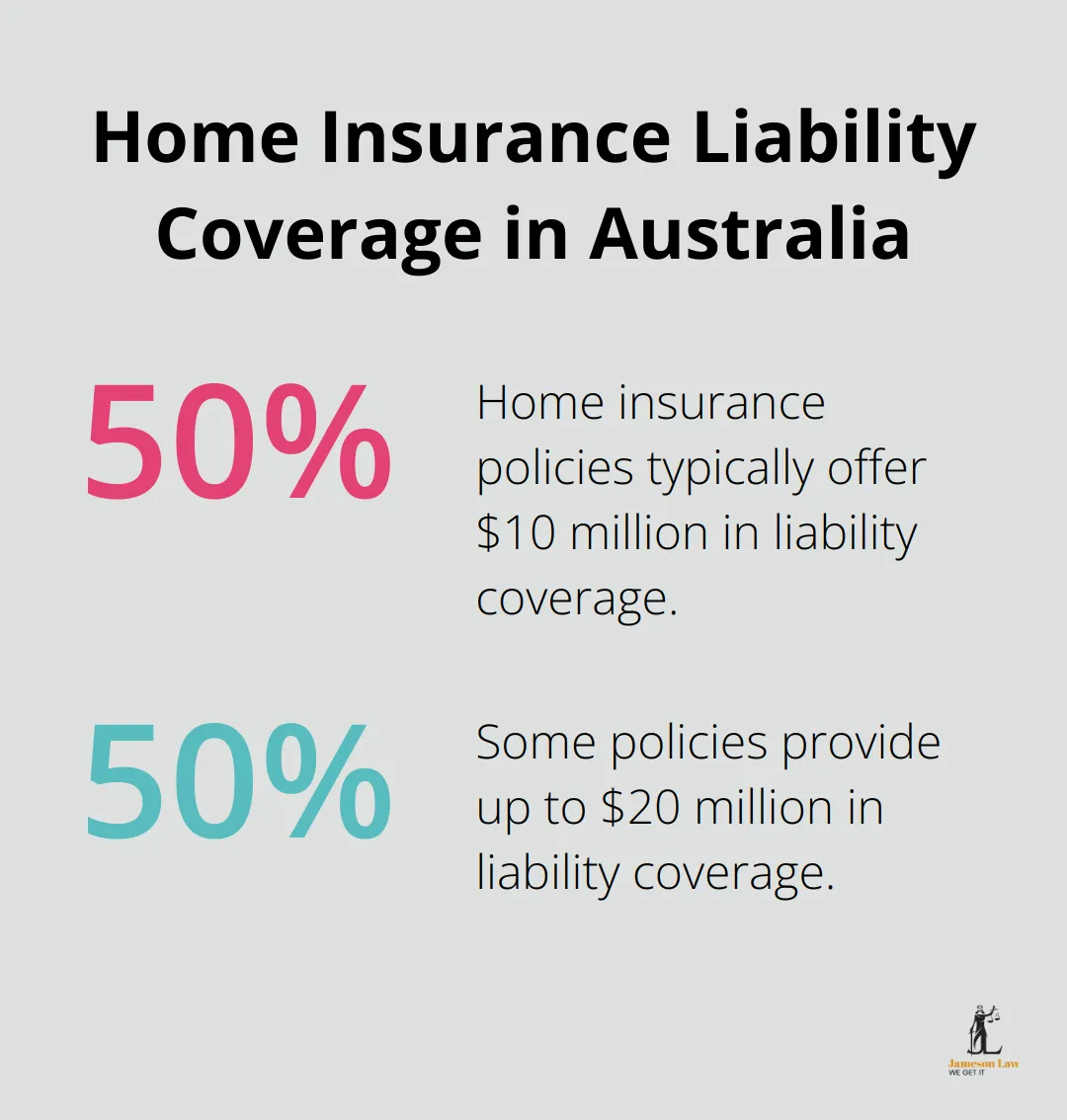

Understanding Liability Coverage Limits

Liability coverage in home insurance policies usually ranges from $10 million to $20 million in Australia. This might seem high, but severe injuries can lead to substantial medical bills and legal costs. According to the Australian Prudential Regulation Authority, the average size of finalised worker claims is around $260,000, which is more than double the $120,000 average size of other bodily injury claims.

You should review your policy regularly and consider increasing your coverage if needed. Factors like owning a pool or trampoline might necessitate higher liability limits.

Public vs Occupiers’ Liability

While both fall under personal injury coverage, there’s a distinction between public liability and occupiers’ liability. Public liability covers injuries that occur off your property but are still your fault (e.g., if your dog bites someone while you’re walking it in a park).

Occupiers’ liability relates to injuries that happen on your property. This includes accidents involving visitors, tradespeople, or even trespassers in some cases. The NSW Civil Liability Act 2002 contains various provisions that stipulate how damages should be calculated for economic and non-economic loss.

Exclusions and Limitations

It’s crucial to understand what your policy doesn’t cover. Most home insurance policies exclude injuries to household members or employees. They also typically don’t cover injuries resulting from business activities conducted on the property.

Some policies might have specific exclusions for certain types of animals or activities. For example, some insurers might not cover injuries caused by certain dog breeds considered “dangerous.”

The Importance of Regular Policy Reviews

Insurance needs change over time. As you make improvements to your home, acquire new assets, or your lifestyle changes, your insurance requirements might also change. Try to review your policy annually to ensure you have adequate coverage.

Now that we’ve covered what home insurance typically covers for personal injuries, let’s move on to the steps you need to take when filing a personal injury claim with your home insurance provider.

How to File a Personal Injury Claim

Document Everything

When an accident occurs on your property, take immediate action. Photograph the accident scene, any hazards involved, and visible injuries. Write down exactly what happened (include the date, time, and weather conditions). This documentation can prove vital if your claim faces disputes. Documenting all expenses related to the injury is essential, in addition to medical records. This includes bills for medical treatments, rehabilitation services, and other related costs.

Notify Your Insurer Promptly

Contact your insurance company as soon as possible. Most policies require notification within 24 to 48 hours. Delays could jeopardize your claim. When you call, request a claim number and the name of the assigned claims adjuster. Keep a record of all communications with your insurer. The Insurance Council sets out timeframes for insurers to respond to claims, complaints, and requests for information from customers.

Gather Solid Evidence

Collect contact information from any witnesses. Their statements can support your account of events. If police responded, obtain a copy of the incident report. For property-related accidents, keep receipts of any emergency repairs you’ve made to address the hazard.

Seek Proper Medical Care

Ensure the injured party receives appropriate medical attention. Keep all medical records (including doctor’s notes, test results, and treatment plans). These documents serve as crucial evidence of the injury’s severity and the necessary care.

Consider Legal Representation

For serious injuries, consult a personal injury lawyer. Expert legal guidance can significantly impact claim outcomes, especially in complex cases. While many law firms offer services in this area, Jameson Law stands out with its No Win No Fee policy for plaintiff personal injury claims and over 40 years of combined experience.

Filing a personal injury claim requires attention to detail and prompt action. The next section will address common challenges you might face during this process and how to overcome them effectively.

Overcoming Common Challenges in Personal Injury Claims

Dealing with Claim Denials

Insurance claim denials occur frequently. While specific statistics are not available, premiums are on the rise as the industry grapples with high claim numbers, soaring building costs, record high inflation, and steep increases in costs. If an insurer denies your claim, take these steps:

- Request a written explanation from your insurer

- Review your policy to ensure the denial aligns with the terms

- Lodge a formal complaint with your insurer’s internal dispute resolution team

- Provide additional evidence or clarification to support your claim

If the internal process fails to resolve the issue, escalate your complaint to the Australian Financial Complaints Authority (AFCA). AFCA offers a free and independent dispute resolution service for financial complaints, including insurance matters.

Navigating Severe Injury Claims

Severe injury claims involve higher stakes and require extensive medical evidence. To strengthen your case:

- Engage medical specialists for detailed reports on injuries, prognosis, and future care needs

- Seek assistance from a personal injury lawyer experienced in severe injury claims

- Gather comprehensive evidence to support your claim for ongoing medical expenses and loss of earning capacity

A skilled lawyer can help you navigate the complexities of the claims process, engage appropriate experts, and negotiate with insurers to secure a fair settlement.

Managing Disputes with Insurance Companies

Disputes with insurance companies often arise in high-value claims. Insurers may contest liability, injury extent, or compensation amount. To manage these disputes effectively:

- Maintain clear and professional communication with your insurer

- Document all interactions (phone calls, emails)

- Request a different claims handler if discussions become unproductive

- Provide relevant information promptly (medical reports, witness statements)

- Consider alternative dispute resolution methods such as mediation

Insurance regulations include 21 pieces specifically protecting customers when buying insurance, dealing with their insurer, or making a claim. For disputed claims, mediation can offer an effective resolution without costly litigation.

Stand your ground on legitimate claims, but remain open to reasonable compromise. Accepting a fair settlement can sometimes prove more beneficial than prolonging the dispute process.

Seeking Legal Representation

For complex cases or when facing significant resistance from insurers, professional legal advice becomes essential. A skilled personal injury lawyer can:

- Assess the strength of your claim

- Gather and present compelling evidence

- Negotiate with insurance companies on your behalf

- Represent you in court if necessary

While many law firms offer services in this area, Jameson Law stands out with its No Win No Fee policy for plaintiff personal injury claims and over 40 years of combined experience.

Understanding Policy Limitations

Insurance policies often contain exclusions and limitations that can affect your claim. Common limitations include:

- Injuries to household members or employees

- Injuries resulting from business activities on the property

- Specific exclusions for certain animals or activities

Review your policy regularly to understand these limitations and consider adjusting your coverage if necessary. This proactive approach can help you avoid surprises when filing a claim.

Final Thoughts

Home insurance often covers personal injury, but policy details and incident circumstances determine the extent of coverage. You must document incidents thoroughly, notify your insurer promptly, and gather solid evidence to support your claim. Regular policy reviews ensure you maintain adequate coverage as your needs change over time.

Prevention reduces the risk of injuries on your property. You should maintain a safe home environment through regular inspections and address potential hazards. This approach protects your visitors and safeguards you from potential liability claims.

Professional legal advice can make a substantial difference in complex cases. Jameson Law offers expert guidance in personal injury claims (with a No Win No Fee policy for plaintiff personal injury matters). Their tailored approach and commitment to achieving the best outcomes can help you navigate the intricacies of personal injury claims effectively.