Estate planning is more than just drafting a will; it’s a comprehensive strategy to protect your assets and legacy. At Jameson Law, we’ve seen firsthand how proper planning can provide peace of mind and security for families.

The art of estate planning involves carefully crafting a roadmap for your future and that of your loved ones. This blog post will guide you through the essential elements of effective estate planning, helping you make informed decisions about your assets and wishes.

What Is Estate Planning?

The Essence of Estate Planning

Estate planning has a vital role when it comes to protecting your valuable assets and ensuring that your loved ones or chosen beneficiaries are taken care of. It empowers you to take control of your legacy and ensures your wishes are carried out precisely.

Key Components of an Effective Estate Plan

An estate plan rests on several crucial elements. A will serves as the cornerstone, outlining your asset distribution preferences. However, it’s merely the beginning. Trusts offer enhanced flexibility and privacy in asset management. Powers of attorney are vital legal instruments allowing a trusted person to act on your behalf in financial, personal, or medical matters. Advanced healthcare directives specify your medical treatment preferences.

Common Misconceptions About Estate Planning

Many Australians mistakenly believe estate planning is exclusively for the wealthy. This notion couldn’t be further from the truth. Everyone (regardless of financial status) can benefit from a well-structured plan. Another widespread myth is that estate planning is a one-off event. In reality, it’s an ongoing process that requires regular reviews, especially after significant life changes (such as marriage, divorce, or the birth of a child).

The Risks of Inadequate Planning

Poor estate planning can lead to severe consequences. Your assets might not be distributed according to your wishes, potentially sparking family disputes. You could also miss out on valuable tax-saving opportunities. In cases of incapacity without proper planning, courts may need to appoint someone to manage your affairs-a process that can be both time-consuming and expensive.

The Role of Professional Guidance

Navigating the complexities of estate planning can be challenging. Professional legal advice can help you create a comprehensive plan tailored to your unique circumstances. A skilled estate planning lawyer can guide you through the process, ensuring all necessary documents are properly prepared and legally binding.

As we move forward, let’s explore the essential documents that form the backbone of a robust estate plan. These legal instruments will help you protect your assets, provide for your loved ones, and secure your legacy for generations to come.

Essential Estate Planning Documents

Wills: The Foundation of Your Estate Plan

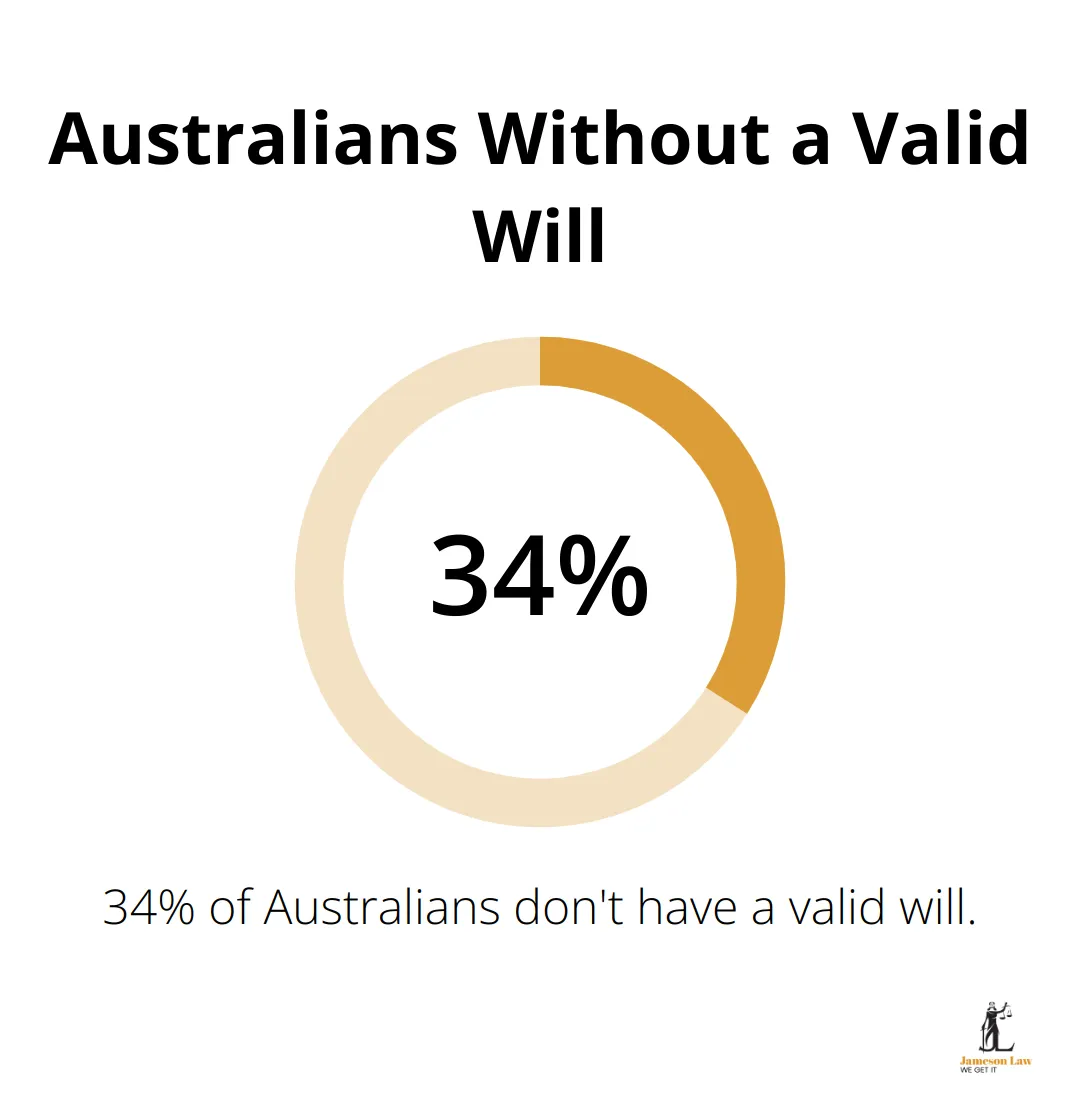

A will forms the cornerstone of any estate plan. It outlines how you want your assets distributed after your death. 34% of Australians don’t have a valid will. This oversight can lead to financial chaos and unintended asset distribution.

To create an effective will, consider these points:

- List all your assets (including property, investments, and personal items).

- Choose your beneficiaries carefully.

- Appoint a trusted executor to manage your estate.

- Review and update your will regularly, especially after major life events.

Power of Attorney: Protecting Your Interests

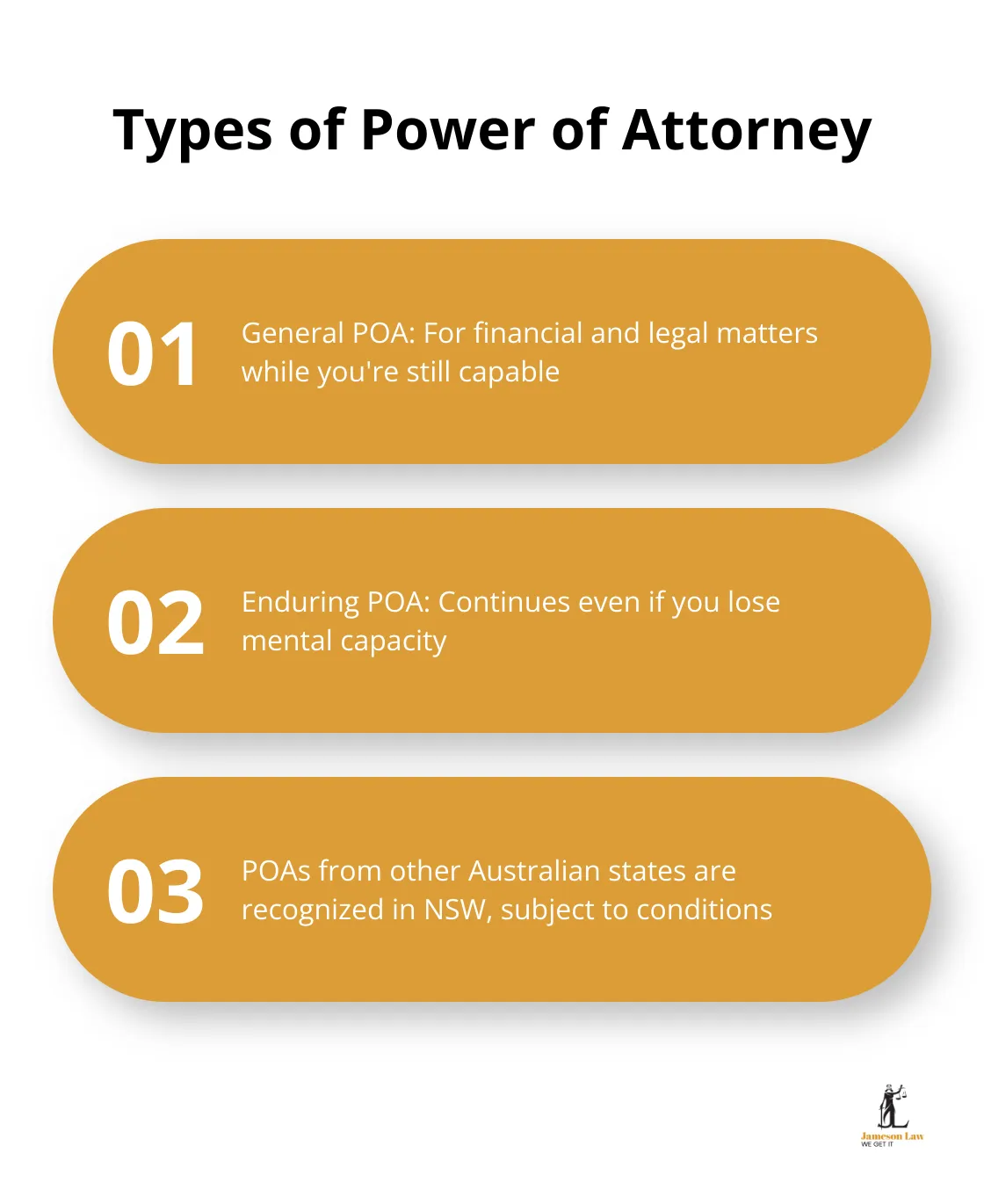

A power of attorney (POA) allows someone to make decisions on your behalf if you’re unable to do so. There are two main types:

Powers of attorney made in another state or territory of Australia are recognized as valid in NSW, subject to certain conditions.

Advance Care Directives: Ensuring Your Healthcare Wishes

An advance care directive, also known as a living will, outlines your preferences for medical treatment if you’re unable to communicate. This document can cover:

- Life-sustaining treatments

- Pain management

- Organ donation

The prevalence of advance care planning in primary care is significantly lower than in aged care and acute hospitals, indicating a major policy challenge for enabling end-of-life care preferences.

Trusts: Flexible Asset Protection

Trusts offer a way to manage and protect your assets both during your lifetime and after death. They can provide:

- Tax benefits

- Asset protection from creditors

- Control over how and when beneficiaries receive assets

The Importance of Professional Guidance

Creating these essential documents requires careful consideration and often professional guidance. A skilled estate planning lawyer can help you navigate the complexities of estate planning, ensuring your legacy is protected and your wishes are respected.

Now that we’ve covered the essential documents, let’s explore effective strategies to maximise the benefits of your estate plan and protect your assets for future generations.

Maximising Your Estate Plan

Reducing Tax Burdens

Estate planning involves more than asset distribution; it requires a comprehensive strategy to protect wealth and legacy. One effective way to maximise your estate is to minimise tax implications. In Australia, beneficiaries generally don’t have any CGT liability when they inherit property. However, it’s important to consider potential tax implications when the property is eventually sold.

Another tax-saving approach involves contributing to superannuation. Concessional super contributions are taxed, but the specific rate may vary depending on individual circumstances and current tax laws.

Shielding Assets from Creditors

Protecting your assets from potential creditors is essential for preserving your estate. Establishing a discretionary trust provides an effective method. This type of trust allows flexibility in distributing assets while offering a layer of protection against creditors.

For business owners, separating personal and business assets is vital. The Australian Securities and Investments Commission recommends using company structures or trusts to hold business assets, which can help shield personal wealth from business liabilities.

Planning for Incapacity

Preparing for potential incapacity is a critical (yet often overlooked) component of estate planning. An enduring power of attorney is essential for managing financial affairs if you become unable to do so. This document continues to operate even after the principal has lost mental capacity.

You should also set up an advance care directive to outline your healthcare preferences. This document provides clear guidance to your family and medical professionals, reducing stress and potential conflicts during difficult times.

Strategic Charitable Giving

Incorporating philanthropy into your estate plan can be personally fulfilling and financially beneficial. The Australian Charities and Not-for-profits Commission reports that Australians donate billions to charities annually. Strategic planning of your charitable giving allows you to support causes you care about while potentially reducing your estate’s tax liability.

You can establish a private ancillary fund (PAF) or a testamentary charitable trust. These structures allow for ongoing charitable contributions and can provide tax benefits for your estate and beneficiaries.

Professional Guidance

Every estate plan is unique. An experienced team (like the one at Jameson Law) can help you navigate these strategies and create a tailored plan that aligns with your personal and financial goals. A proactive approach to estate planning ensures that your legacy is protected and your wishes are honoured.

Final Thoughts

Estate planning is an art that requires careful consideration of various legal instruments, tax implications, and personal wishes. It goes beyond drafting a will to create a comprehensive strategy that protects assets, provides for loved ones, and secures legacies. We at Jameson Law understand the complexities involved in this process and the importance of tailoring solutions to individual needs.

Our experienced team can guide you through every step, from drafting essential documents to implementing sophisticated strategies for asset protection and wealth preservation. We will help you create a robust estate plan that reflects your wishes and secures your legacy for generations to come. With our expertise in wills and estates, we aim to provide you with peace of mind about your family’s future.

Don’t leave your future to chance. Take control of your legacy today and ensure that your hard-earned assets are protected and distributed according to your wishes. Contact Jameson Law to start mastering the art of estate planning and secure your family’s future with confidence.